Shipping Industry Pushes Toward Electronic Bills of Lading as Adoption Reaches 11% in 2025

The global shipping industry is accelerating its transition from paper to electronic bills of lading (eBLs), with adoption reaching 11% by mid-2025, according to data from the Digital Container Shipping Association (DCSA).

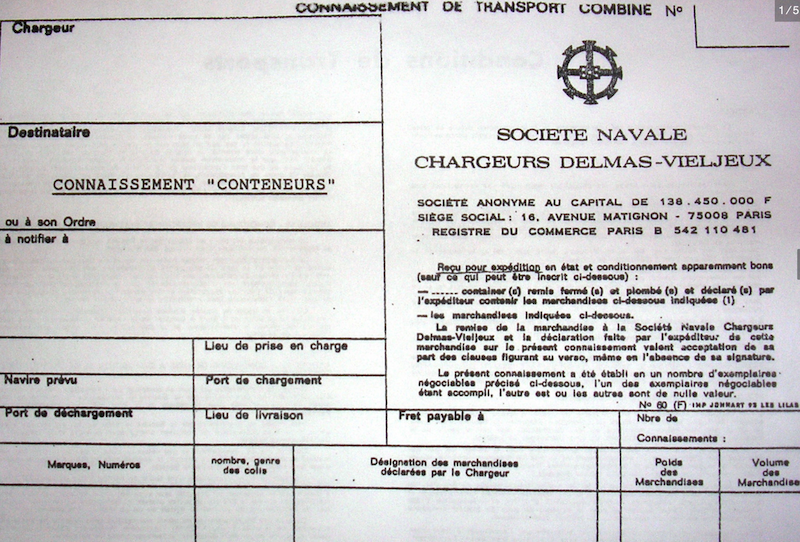

For centuries, the paper bill of lading has served as the cornerstone of international trade, acting as both a receipt and a document of title. But the process is slow, expensive, and vulnerable to errors. A shipment from Australia to China, for example, can be held up for weeks as the paper document travels through multiple banks in London and Singapore before reaching the consignee. Delays often lead to costly demurrage charges or risky workarounds such as letters of indemnity.

Adoption of eBLs has grown steadily in recent years. In 2021, just over 1% of bills were issued electronically. By August 2025, this number had climbed to 11%. Nearly half of industry respondents now report using eBLs in some form, compared to one-third in 2022.

Container shipping is leading the charge. Maersk, MSC, CMA CGM, Hapag-Lloyd, ONE, Evergreen, Yang Ming, HMM, and ZIM have committed to 100% electronic bill adoption by 2030. Bulk sectors, including iron ore and crude oil shipments, are also seeing growing uptake, with digital penetration surpassing 25% in some trades.

Legal and Regulatory Shifts

A major hurdle to widespread adoption has been legal recognition. In May 2025, the Dutch government introduced legislation granting eBLs the same status as paper bills, aligning with earlier reforms in France, Germany, and the UK. The law includes a three-year review period to consider extending recognition to other transport documents.On the insurance side, the International Group of P&I Clubs implemented a new approval process in February 2025. Electronic systems operating under legally recognized frameworks are now automatically accepted if they meet audit and reliability standards. This streamlines compliance for carriers and shippers alike.

Interoperability Breakthrough

Until recently, fragmented platforms limited scalability. That changed in May 2025, when the DCSA facilitated the first standards-based interoperable eBL transaction. The pilot included CargoX and EdoxOnline, with additional providers such as Enigio, WaveBL, and TradeGo preparing for similar transactions.The initiative introduced a Platform Interoperability (PINT) API, a legal framework for provider-user relationships, and a Control Tracking Registry to ensure transparency. This development enables cargo owners, banks, and carriers to work across systems without being locked into a single platform.

Cost and Efficiency Gains

Research highlights the economic case for digitization. McKinsey estimates universal adoption could save $6.5 billion annually in documentation costs and reduce inventory and financing expenses by another $7 billion. Broader efficiency gains could support $30–40 billion in additional global trade.

Environmental benefits are also evident. Widespread use of eBLs could save 28,000 trees per year and cut emissions linked to document transport and storage.

Standards and Technology Updates

The DCSA published its Bill of Lading 3.0 standard in early 2025, adding digital signatures and more than 190 attributes to meet EU Import Control System 2 requirements. These updates aim to improve security, regulatory compliance, and ease of integration with existing systems.

In parallel, the North American less-than-truckload sector has advanced its own digital documentation. The National Motor Freight Traffic Association’s Digital LTL Council introduced eBOL 2.1 standards in 2024, with C.H. Robinson and 10 major carriers already adopting the system. Industry analysts project savings of up to $470 million annually once the rollout is complete.

Barriers Still Present

Despite progress, adoption remains uneven. The DCSA identifies “soft barriers” as key challenges: reluctance to change established practices, limited leadership focus, and uncertainty about peer readiness. Many shippers remain cautious, preferring to wait until critical mass is reached before committing fully.

Security and system integration concerns also persist. Companies face upfront investment costs to adapt their internal processes, while cyber risks demand constant attention to safeguard sensitive trade data.Even with these obstacles, momentum is building. MSC recently reported exponential growth in its eBL program, handling hundreds of thousands of electronic documents. With mounting pressure to cut costs, improve efficiency, and meet sustainability targets, the industry appears set to continue its shift away from paper-based trade documentation.

Source : Breakbulk